My experience using Collective.com

👉 Note: I'm a Collective.com member and this article includes affiliate links.

I used to run my business as a sole proprietorship. For accounting, bookkeeping, and taxes, that meant:

- Establishing separate accounts for personal + business

- Generating monthly revenue from freelance copywriting

- Taking owner's draw to pay myself from my business

- Paying estimated quarterly taxes per my own math

- Hiring an accountant for year-end taxes

- Hoping I did it right to avoid tax liability

Some years, it all evened out. Other years, it cost me, as it sometimes does for solo business owners. When my annual business revenue crept up toward $100K, I knew I had to look into new options for accounting and bookkeeping.

Otherwise it wasn't sustainable.

So I signed up for Collective.com to do it all for me. I've been a member since 2021. What follows is my in-depth review of the Collective back-office tax platform. I hope it helps you on your journey as a solopreneur.

1. What is Collective.com?

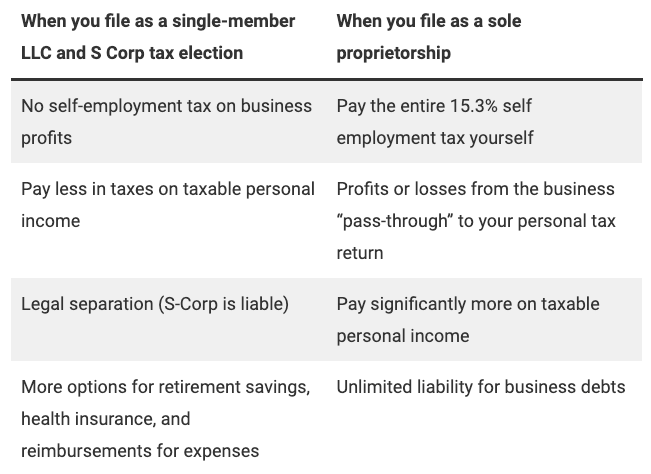

Collective.com is a subscription accounting and bookkeeping service designed for self-employed people. Their unique selling proposition is the LLC/S Corp approach, which offers some advantages compared to running a sole proprietorship:

Members pay a monthly fee for these core services:

- LLC formation

- S Corp election

- Payroll

- Monthly bookkeeping

- Financial reports

- Quarterly tax estimates

- Year-end tax filing

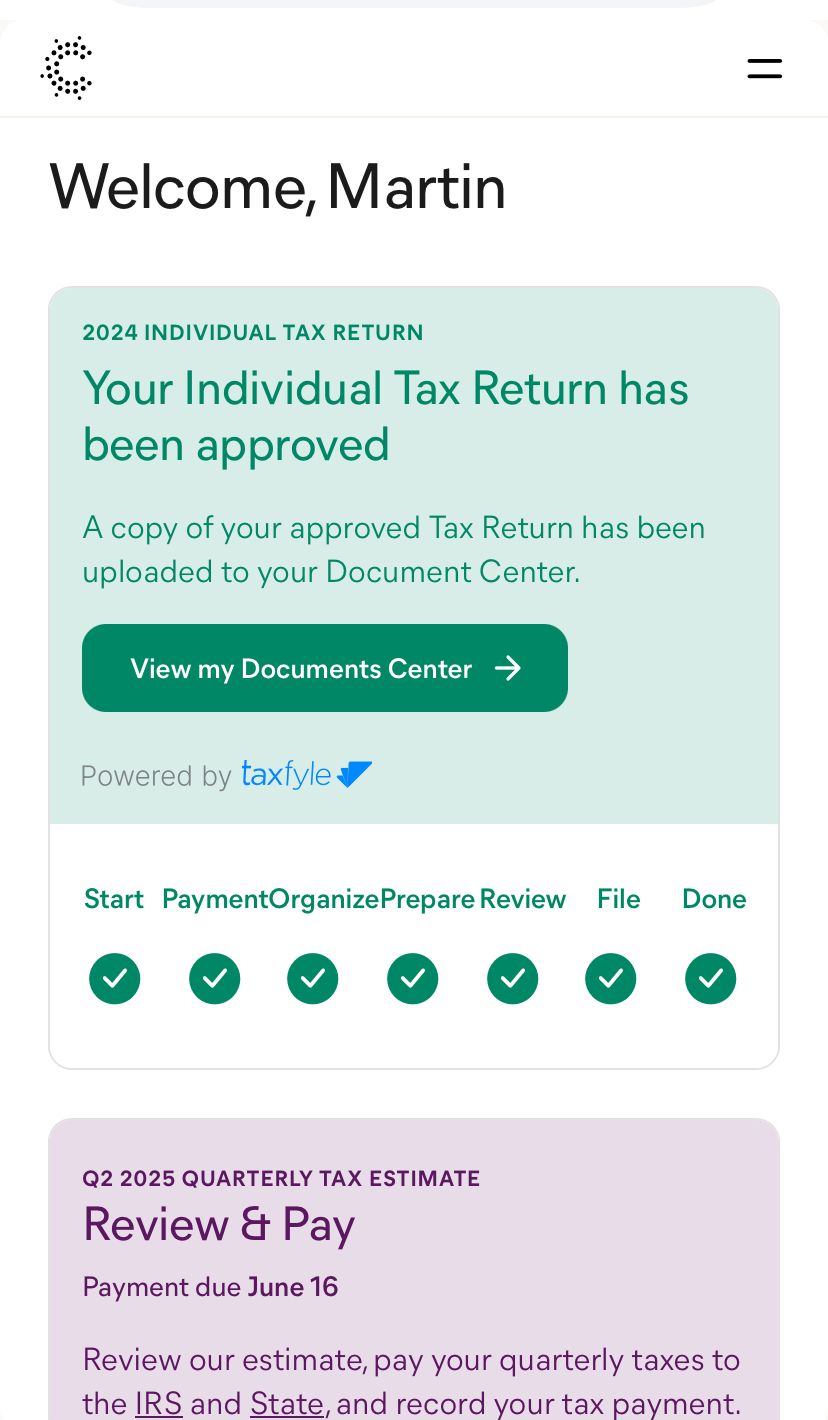

Membership centers around a browser-based dashboard.

This is where members can perform required tasks, upload documents, get asynchronous support, and so on. Here's what my Collective.com dashboard looks like today (on mobile):

And here is a view of the main menu to show you the different options available to me as a member:

2. Who is Collective.com for?

To become a Collective.com member—and, more importantly, to make the cost of Collective.com worth it—must:

- Be a self-employed entrepreneur

- Reside in one of 50 U.S. states

- Generate at least $80K in annual revenue

I'm a freelance content and copywriter. Among members, you'll find executive coaches, software founders, product developers, and podcasters—digital advertisers, art directors, and trademark attorneys.

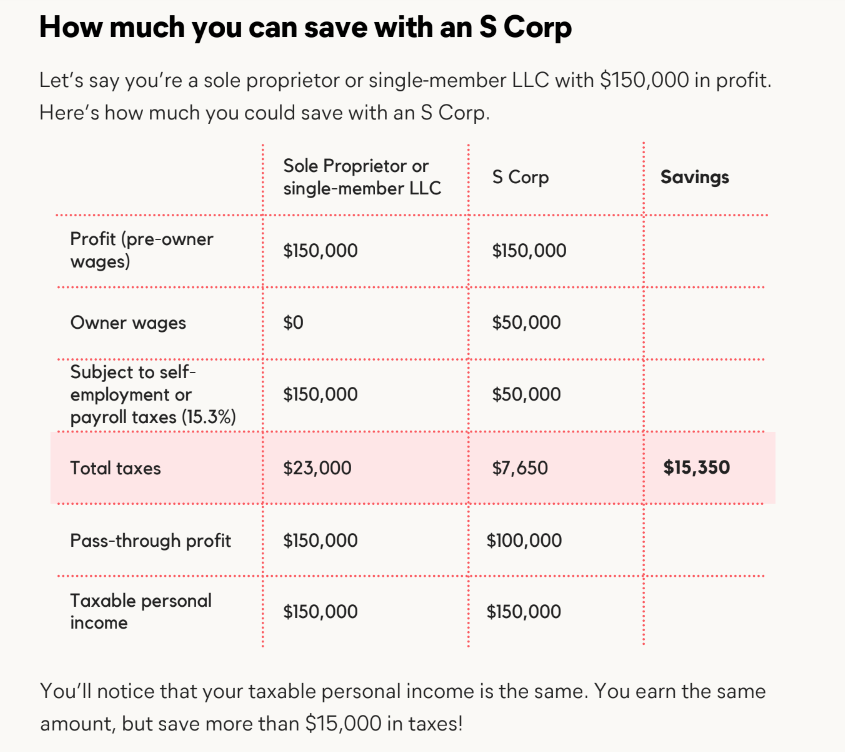

The revenue baseline is worth re-emphasizing. Collective claims that its members save an average of $10,000 per year by using this service to switch to an S Corp. In order to realize these savings—and to make the cost of Collective worth it—your business needs to bring in enough consistent revenue.

Keep in mind that on top of your membership costs, you'll have business costs associated with being an LLC taxed as an S Corp. These will include:

- Annual franchise tax (depending on your state)

- Monthly reimbursements for business expenses

- City and state fees

You'll also have to keep a rather significant balance in your business account. During onboarding, my rep recommended that I keep something like $10,000 – $15,000 in my business checking account untouched.

If you start having slow months, or your available balance begins to dwindle, the quarterly onslaught of estimated taxes and monthly business expenses alone will get on top of you fast.

Some may find that these financial requirements are too steep for their current situation.

Is Collective right for you? Get a free review to check

The best way to see if this is a good fit is to request a complimentary review. You'll complete a form to pre-qualify, then participate in a short video chat to discuss the next steps, ask questions, etc.

3. How much does Collective cost?

Currently, new members pay $349/month ($296/month if paid annually). This fee includes business formation, taxes, bookkeeping and accounting, invoicing, payroll, and compliance and support.

If you want Collective to file your individual tax returns, you have to pay an annual add-on fee starting a $199/year.

If you sign up for the monthly plan plus the basic individual tax return service, your annual fee is $4,387.

For the most up to date information, see the Collective plans and pricing page.

4. Main advantage: tax savings

The platform has changed since I first became a member in 2021. But I've found Collective's claims of significant tax savings to be mostly true. In every year but one since switching to Collective.com, I've either owed nothing at tax time, or received a refund.

Other advantages of Collective.com

I've read mixed reviews as to how Collective handles customer support. When you have a question or issue, you can either email a central email address, or send a message through the member dashboard.

From what I can tell, support messages are directed to a dispersed team that "swarms" the issue based on availability and issue expertise. I've never had to go much longer than 48 hours before receiving a response.

In addition to direct email support, you also have access to Collective Help Center. This is a searchable, regularly updated knowledge base covering many of the most commonly asked questions.

In addition to the Collective Help Center, members have access to the Collective Community. This is essentially a user forum in which members can introduce themselves, post jobs, ask questions, and participate in workshops. The community is quite active and has dedicated Collective employees to keep things fresh—highly recommend.

Being a member also has its perks. On the Collective Community site, you can find a regularly update list of member perks. Currently, those perks include discounts on banking and travel services, business services (AI, chat, and website subscriptions), health insurance, and scholarship for a business growth bootcamp.

Overall, my books are in a lot better order. I'll give you an example: estimated tax payments. My 2021 Q1 estimated payment as a sole proprietor was $5,000. In 2024, my total estimated tax payments for the year were $4,700. What’s more, the team reminds me to pay estimated taxes each quarter, including a recommended amount based on real-time accounting and bookkeeping for that quarter.

Huge plus.

5. What Collective.com could do better

I'll start with the process for year-end tax filings. Recently, Collective announced a partnership with TaxFyle, a third-party that now handles the tax filing process. Now, come tax time, I have to use an embedded third-party process, including interactions with a TaxFyle representative, to handle the entire process.

It's not bad, but it's different and requires more effort. It's less personal than the process was previous to this partnership. However, I don't have to pay the extra fee for TaxFyle services, as new members do. Having to do so might well change the calculus, so if the extra fee is a dealbreaker for you, I would certainly understand.

On a related note, I've had to file an extension every single year that I've been a Collective.com member. I can't put this all on Collective; but it's an indicator of how this multi-step, multi-player process sometimes goes.

Something to keep in mind.

6. Parting thought: think it through

Collective.com is not for everybody. The company is actually quite explicit about that. My experience has not been some magic silver bullet that solves all my bookkeeping, accounting, and tax issues.

Back when I was still a sole proprietorship, my accountant looked at me and said, "You've got a legitimate business here. Time to treat it like one, starting with your books."

Herein lies the rub: in doing so—by becoming a Collective.com member—I've definitely matured in terms of how I run my books and file taxes. But there's more responsibility, both in terms of finances and personal time and effort, that go along with it all.

- Running payroll and taking distributions

- Completing expenses and reimbursements every month

- Setting money aside for ongoing costs, fees, and taxes

- Keeping up with all of the extra filings and paperwork

Hesitant Based On this a Collective S Corp Review? Try it Free First

If you struggle with estimated taxes, bookkeeping, and accounting for your business of one, an S Corp could work for you. As a general rule, if your solopreneurship generates more than $80,000 in revenue annually, there’s a good chance you’ll save some money going this route.

If you just want to try it, get a free one-month trial of Collective on me.