Should Freelancers Use Collective S Corp Back-Office Tax Platform?

I use this back-office tax platform to manage the accounting, bookkeeping, and taxes for my freelance business. Here is my honest Collective S Corp review, which I'll periodically update after each tax period.

*Disclosure: This site participates in affiliate programs. So you know, Copy Martin, LLC may earn some recompense from the companies mentioned in this here Collective S Corp review. Thought you should know that before reading!

Back in 2021, I was paying $5,000 every quarter toward estimated taxes. It was my first year as a full-time freelance writer and there was no guarantee I would hit my revenue goals each month.

So I was paying based on what I reasonably thought I’d clear that year. At the end of the year, it looked like I’d hit my target revenue mark. I’d made all of my estimated tax payments to the IRS on time, too—$20,000 in total.

Home free, until tax time came around and I still owed thousands.

What My Business Looked Like Before Switching to Collective

Turns out, I wasn’t paying the right amount toward estimated taxes. Come to think of it, that’s not all I was doing wrong. Which isn’t surprising. I’m a writer, not a tax expert. Numbers elude me. I got a C in high school geometry before failing algebra trig.

Since I took my first freelance writing assignment back in 2010, it has been a whole lot of try, fail, refine, especially when it comes to accounting and taxes.

1. Started as a Sole Proprietorship

In 2018, I finally established my sole proprietorship in San Diego. Until 2020, that sole proprietorship was a side hustle—I took on various content writing and copywriting assignments on a freelance basis.

Ultimately, my goal was to build this business up to a point where I could leave my corporate job, which I did in September 2020.

2. Hired an Accountant to Handle Personal and Business Taxes

In terms of the numbers—i.e., revenue tracking, expenses, accounting, bookkeeping—I’m not going to lie: I didn’t know what the hell I was doing. I was wise enough to create separate bank accounts for my business and personal finances. I didn’t have many expenses to track, aside from a few subscriptions I needed to run my business (Upwork and Freshbooks, to name a few).

I did hire an accountant to handle my taxes every year (Golden Hill Tax Solutions). Each sit-down with Ed was like a crash course in personal and business accounting, so no complaints there.

3. Did My Best to Manage Business Finances On My Own

My process for paying myself and tracking businesses finances was informal, to say the least. I spent a lot more time working and generating revenue than I did sorting my books out. Here’s the step-by-step process to give you an idea of how I did it before subscribing to Collective:

Invoice clients through Freshbooks or Upwork

Keep business revenue in a separate checking account

Cut checks (owner’s draw) to transfer funds from business to personal checking

Set aside money each month for estimated taxes

Make quarterly estimated payments

Dump all of my forms, receipts, and other material on my accountant’s desk come tax time

Hope I did it right

If it sounds messy, that’s because it was. For the first year, this system worked just fine—the IRS actually cut me a check after it was all said and done. Except that I was still working full time and freelance only accounted for 30-40% of my total annual income.

Things would change when I went full-time and hit my first six-figure year.

Why I Decided to Let Collective Accounting Review My Business

Toward the end of 2021, I started looking into new options for accounting and bookkeeping. I came across the notion of switching to an S Corp—something I knew nothing about—with the potential to save me money on taxes each year. Then I discovered Collective, “the first online back-office platform designed for self-employed people.” Their program looked good, so I decided to schedule a call and have Collective accounting review my business.

Here’s why I was considering the Collective S-Corp back office tax platform:

Difficulties managing my own finances, books, and taxes

Not knowing if my methods were accurate, correct, and compliant

Worrying that I’d owe a lot of money to the government at the end of the year

The convenience of having someone else do it for you each month

How Does a Collective Tax Review Work?

After I filled out the form, a rep from Collective scheduled a Zoom call to see if my business qualified for their program. On that call and thereafter, I learned a few things about Collective that sealed the deal for me:

An all-in-one platform for S Corp formation, accounting, taxes, bookkeeping, and compliance

It’s for solopreneurs who make generate $80,000+ revenue each year

Average member saves $9,000 in taxes annually

Anytime access to the team if I have question or concerns

Includes annual tax filings for my family and business

Includes QuickBooks and Gusto for payroll

Serves my state, California, along with: Arizona; Florida; Georgia; Massachusetts; Pennsylvania; Texas; Virginia; Utah; and Washington

How Much Does a Collective Membership Cost?

Currently, I pay $299/month for my Collective membership. Honestly, the monthly fee did raise an eyebrow for me, at first. At the time, I wasn’t exactly chomping at the bit to pay hundreds of dollars a month for accounting and bookkeeping. However, the fee is tax deductible.

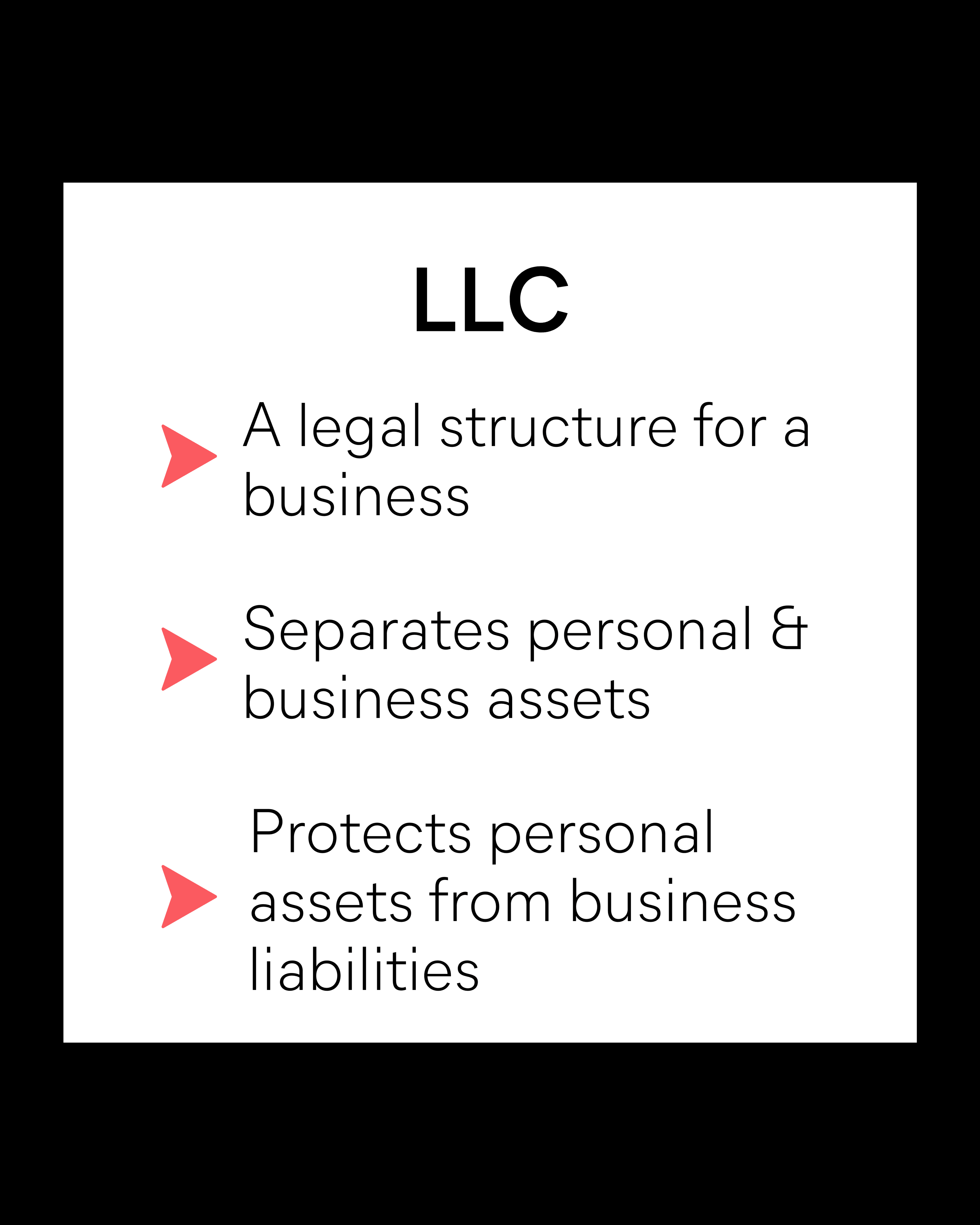

Advantages of an S Corp vs. Sole Proprietorship

When you file as a single-member LLC and S Corp tax election | When you file as a sole proprietorship |

No self-employment tax on business profits | Pay the entire 15.3% self employment tax yourself |

Pay less in taxes on taxable personal income | Profits or losses from the business “pass-through” to your personal tax return |

Legal separation (S-Corp is liable) | Pay significantly more on taxable personal income |

More options for retirement savings, health insurance, and reimbursements for expenses | Unlimited liability for business debts |

What I Like About My Collective Membership

Here’s what really stands out to me about my Collective membership, so far:

Self-Service Onboarding and Education

Customer service is important to me. Collective has a terrific onboarding and education process. Check out the company’s blog and help center to see what’s what—it’s a crash course in taxes and bookkeeping for freelancers.

LLC and S Corp Formation

If I were to go this route myself, I’d have trouble figuring it out. The Collective team handled nearly every aspect of forming my LLC and S Corp tax election, from filing licenses to ensuring compliance.

Accurate Estimated Tax Payments

My 2021 Q1 estimated payment as a sole proprietor was $5,000. In 2022, my Q1 estimated payment was $750, a $4250 difference. Assuming the trend holds, I’ll save around $10,000 on my 2022 estimated taxes. What’s more, the team reminds me to pay estimated taxes each quarter, including a recommended amount based on real-time accounting and bookkeeping for that quarter.

Communication Style

When I have a question about nearly anything—e.g., can I expense the damages to the Ferrari I crashed on a test drive?—I just send an email and a CPA responds within 24 hours. Honestly, the asynchronous nature of communications works for me and my daily schedule.

Expenses and Reimbursements

Each month, I fill out a monthly expenses reimbursement worksheet, then cut a check into a personal account based on that worksheet. All in all, my expense tracking has been much more efficient and accurate. And for the first time in my freelance writing career, I’m reimbursing myself for expenses the right way.

Collective Referral Program

The Collective Referral Program is robust potentially lucrative. Their team provides regularly updated referral assets for use on social media, a community support program, and personalized guidance.

5 Things to Remember About Using the Collective Back-Office Tax Platform

As with any service, not everyone has the same experience as I’ve had with Collective. I was poking around some online forums and saw some users point out five things that I’ve experienced myself.

1. Tax returns and filing extensions is still somewhat complicated

Each year since I joined Collective, their team has filed an extension for my tax return. As part of that process, I had to pay my estimated taxes up front. It was sudden and the amount was significant (in the thousands).

There's also your broader tax situation to consider. Collective will file your personal and business tax returns. With regard to the former, you might run into some hiccups, such as:

Married filing jointly or married filing separately

Solar projects, major home improvements, etc.

Investments and crypto currency proceeds

2. Communication and customer service are done entirely by email

When I’ve had questions, I write an email to a generic address. Later, I’ll receive a response from somebody working on my account. So far, the same CPA has responded to all of my queries, with a separate contact for issues related to my tax return.

For me, the asynchronous communication works just fine, though I can understand why others might not like this.

3. Running payroll and taking distributions will be an adjustment

Whereas I could cut owner’s draws any time for any amount as a sole proprietor, I now run payroll twice a month based on my “reasonable salary.” I can take separate distributions, but have to be careful to avoid being penalized.

As to the actual threshold for how much distribution I can take, the answers have been rather vague. For more, read: Collective Payroll Overview.

4. You're required to complete expenses on a monthly basis

As part of the LLC business setup, you'll be required to file expenses every month. This includes using a web-based form on the Collective website to report things like home internet fees, travel, mortgage interest paid, and so on.

Based on each month's expenses, you'll be required to reimburse yourself for a percentage of your business expenses. For me, this amounts to about $550 a month that comes out of my business banking account.

Here's a comprehensive overview of the process: The Accountable Plan and Getting Reimbursed for Personal Expenses

5. You'll need to have money set aside for ongoing costs, fees, and taxes

During onboarding, my rep recommended that I keep something like $10,000 – $15,000 in my business checking account untouched. On top of that, I'm to run expenses, pay estimated taxes and annual state and federal business fees, and run my regular payroll from the additional revenue I generate from my business.

This is a big one.

If you start having slow months, or your available balance begins to dwindle, the quarterly onslaught of estimated taxes and monthly business expenses alone will get on top of you fast.

Hesitant Based On this a Collective S Corp Review? Try it Free First

Overall, I’m pleased. When I was still working in-house while juggling the side hustle, forming an LLC with S Corp tax election way over my head. And I did need help with almost every aspect of the process. After my first full year with Collective running the show, two things stand out:

My estimated tax payments were far less than I was paying before

I received a state and federal refund after filing—both in the thousands

If you struggle with estimated taxes for your business of one, an S Corp could work for you. As a general rule, if your solopreneurship generates more than $80,000 in revenue annually, there’s a good chance you’ll save some money going this route. If you just want to try it, get a free one-month trial of Collective on me.

Take it for a spin and see if this Collective tax review matches your experience. Speaking of your experiences, I’d love to hear from people who’ve used Collective.

![Why choose an S Corp for your freelance business [Collective Back-Tax Platform Review]](https://d1vpxlyg2m71rm.cloudfront.net/?k=clvwlv53z000kzq6ad8tazov1%2Fcly4vvotm000s0cl6hiwga949.png&w=3840)